Overview

Damu Entrepreneurship Development Fund JSC is Kazakhstan’s leading micro-, small and entrepreneurship (MSME) development institution. The mission of the Fund is to play an active role in the sustainable development of MSMEs through t he implementation of comprehensive and effective support instruments. Substantial government support allows the Fund to conduct successful activities for the development of small and medium-sized businesses.

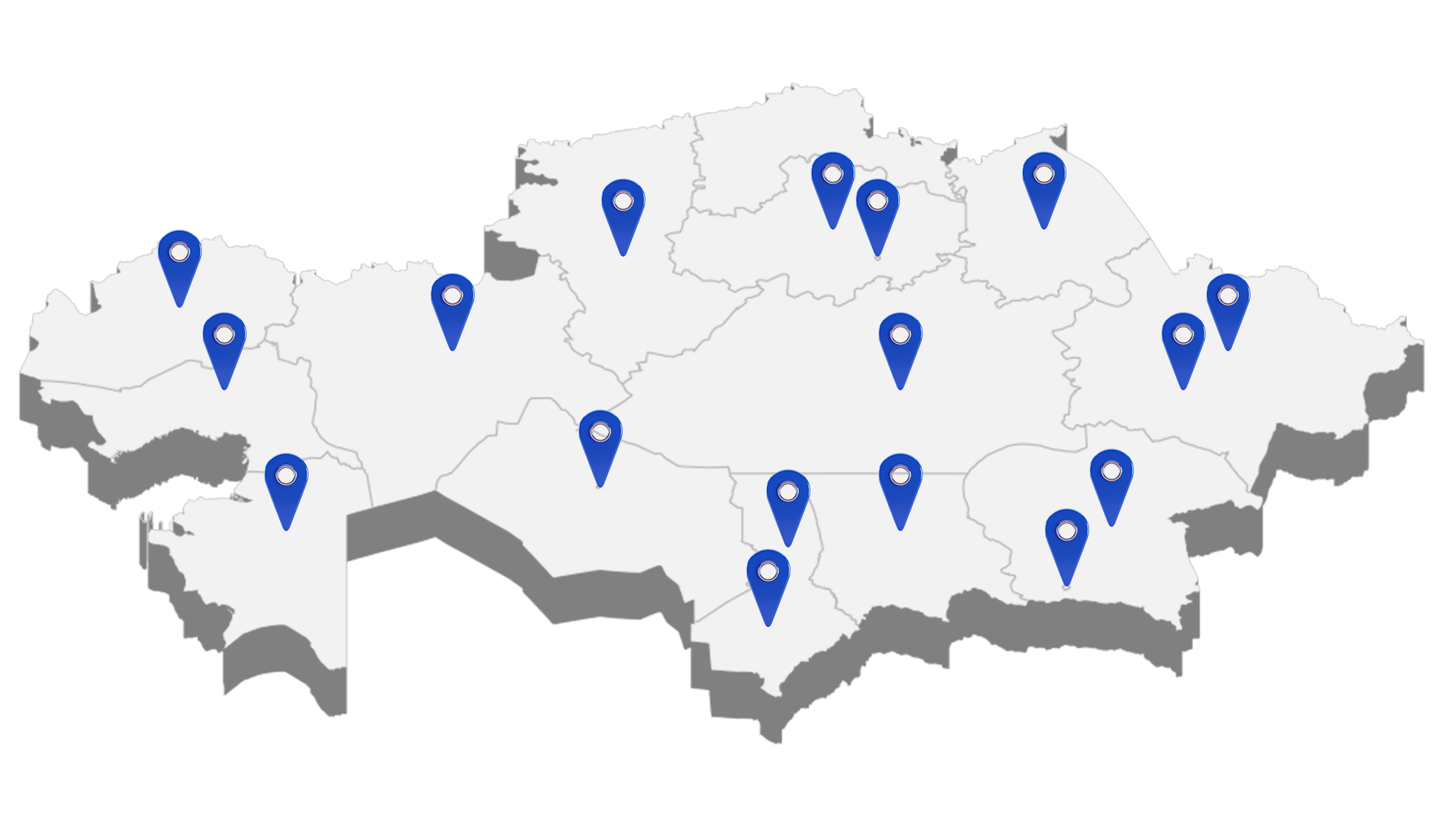

Damu Fund’s headquarters is located in Almaty, the financial and cultural center of Kazakhstan. There are 16 branches and 2 representative offices of Damu Fund across the country.

Kazakhstan is located in Central Asia region between Russia and China. The continental position of Kazakhstan in the center of the Eurasian continent is reflected in its cultural and socio-economic features. Kazakh and Russian languages are spoken in the country, with Kazakh being the national language.

The population of the country reached 19 million in 2021. According to the World Bank, Kazakhstan’s GDP per capita increased six times and the country transitioned from lower-middle-income to upper-middle-income rank in less than twenty years.

Definition of MSME in Kazakhstan

The status of a business entity is influenced by the average annual number of employees, average annual income.

- Micro enterprises: entities engaged in private entrepreneurship with an average annual number of employees of no more than 15 people or an average annual income of no more than 30,000 MCI.

- Small enterprises: individual entrepreneurs and legal entities engaged in entrepreneurship with an average annual number of employees of no more than 100 people, an average annual income of not more than 300,000 times the monthly calculation index (MCI) established in force on January 1 of the corresponding financial year.

- Medium enterprises: individual entrepreneurs and legal entities carrying out entrepreneurship, not related to small and large businesses, that is, meeting the following criteria: the average annual number of employees is from 101 to 250 people; and (or) the average annual income is above 300,000 times the MCI, but not more than 3,000,000 times MCI inclusive.

Sustainable Development

Damu Fund takes measures to achieve the Sustainable Development Goals. Damu Fund’s Sustainable Development Policy is developed according to international practices and addresses measures to improve social, economic and environmental progress.

In Kazakhstan, women make up 51% of the total population and 49% in the share of the employed population. The share of the contribution of female entrepreneurship to GDP is 39%.

In 2019, UN Women headquarters in New York approved Damu Fund’s application to become one of Kazakhstan’s 38 Women Empowerment Principles (WEPs) Signatories. The WEPs are 7 Principles set to offer guidance on how to empower women in the workplace, marketplace and community. This document has been signed by 4144 companies (as of December 2020), including Google, Citigroup Inc, Nasdaq, PwC, Ernst & Young and Coca-Cola.

Over the past decade, five major instruments of the Fund were developed in order to support women: program of conditional placement of funds in second-tier banks for subsequent crediting of women's entrepreneurship using funds provided by Asian Development Bank (ADB), European Bank for Reconstruction and Development (EBRD) Women in Business program and the State Program for Support and Development of Business Business Road Map 2025, partial loan guarantees and the loan interest rate subsidizing.

Damu Fund developed and approved internal documents related to ecology and green financing, in accordance to which it actively supports the green direction of MSME financing.

In August 2020 Damu Fund with the support of UNDP carried out successful debut placement of green bonds on the Astana International Exchange with 11.75% per annum coupon rate and a circulation period of 3 years.

Funds from the placement of bonds will be directed to second-tier banks, microfinance organizations for further lending to SMEs implementing green projects.

In addition to subsidizing part of the Fund's green bonds coupon rate, UNDP also provides technical support for green projects.

Green bonds issuance was implemented in the frame of a new agreement between Damu Fund and UNDP Kazakhstan, within the framework of the GEF project "Reduction Of Investment Risks In Renewable Energy". The conditions of the agreement also included financial support mechanisms for MSMEs: 10% subsidizing by of the loan interest rate and subsidizing loan principal amount up to 25%.

This is not the first agreement between Damu Fund and UNDP. In August 2017, with the participation of the Ministry of Investment and Development of the Republic of Kazakhstan, Damu Fund and UNDP Kazakhstan launched a model of financial support for business initiatives aimed at reducing greenhouse gas emissions-CO2 into the atmosphere within the framework of the Sustainable Cities For Low-Carbon Development in Kazakhstan project.

A joint initiative of UNDP and Damu Fund helps to promote Kazakhstan's fulfillment of its obligations under the Paris Agreement, as well as the achievement of target indicators for sustainable development goals.

Damu Fund has several programs aimed at microfinancing. The objectives of the programs are to promote the qualitative development of the microfinance sector in Kazakhstan and create an alternative source of financing for micro, small and medium-sized private entities.

In Kazakhstan, microfinance institutions help people in rural areas with limited access to financing. In accordance with the information on the state of the microfinance sector of the Association of Microfinance Organizations of Kazakhstan for the 2020 Q3, the loan portfolio of MFIs as of October 1, 2020 amounted to 380 billion tenge, the share of microloans provided to women in total is 52%, this indicator has not changed since the beginning of the year.

Who can become a partner?

We work with international organizations, such as the United Nations Development Program and World Bank. Our creditors are both state institutions and international financing organizations, such as the Asian Development Bank, European Investment Bank and European Bank for Reconstruction and Development.

Our lenders are leading and most reliable local financial institutions – commercial banks, microfinancing institutions, leasing companies.

Our knowledge exchange programs and B2B events are implemented with foreign development institutions, such as Turkey’s Small and Medium Enterprises Development Organization KOSGEB, SME Development Bank (Russia) and Korea’s SMEs and Startups Agency (KOSME).

You can work with Damu Fund if you want to invest in MSME development in Kazakhstan, and offer non-financial support i.e. learn and share best practices in MSME support, host educational and networking events for MSME’s.

Your Next Step

If you would like to find out more about partnering up with Damu, email Funding & International Relations Department team at

Funding@fund.kz.

The tasks of the Funding and International Relations Department are:

- attraction of financing for support and development of private entrepreneurship from local and external sources,

- organization of internships for employees of the Fund in international/foreign organizations and development institutions;

- analysis of international experience in support and development of private entrepreneurship;

- implementation and coordination of the Fund's activities for the development of international cooperation.